Your Ultimate Guide to Leave Salary Calculation in UAE (MOHRE Rules 2025)

Navigating employment regulations in the UAE can seem complex, especially when it comes to understanding your entitlements like leave salary. Whether you’re an employee wanting to know your rights or an employer ensuring compliance, getting leave salary calculations correct is crucial. This guide breaks down everything you need to know about leave salary calculation in the UAE, referencing the Ministry of Human Resources and Emiratisation (MOHRE) guidelines and the latest UAE Labour Law.

Understanding MOHRE: What Is It and Why It Matters

What is MOHRE?

MOHRE stands for the Ministry of Human Resources and Emiratisation. It’s the primary government body responsible for overseeing labour rights, regulations, and employment standards in the UAE’s private sector.

Why MOHRE Matters for Leave Salary

MOHRE sets the framework for employment contracts, working hours, wages, leaves, end-of-service benefits, and dispute resolution. The UAE Labour Law (Federal Decree-Law No. 33 of 2021), enforced by MOHRE, dictates the rules for all types of leave and their corresponding salary calculations. Understanding MOHRE’s regulations is essential for both employees and employers to ensure fair treatment and legal compliance regarding leave entitlements. When we discuss “leave salary calculation in UAE MOHRE,” we are referring to the calculations mandated by the law that MOHRE oversees.

Eligibility Criteria for Paid Leave in the UAE

Generally, full-time employees working in the UAE’s private sector are entitled to various types of paid leave after completing their probation period. Key eligibility points include:

- Employment Contract: You must have a valid employment contract registered with MOHRE.

- Service Duration: Entitlement to certain leaves, like annual leave, often depends on the length of service.

- Probation Period: While probation (maximum 6 months) is a standard assessment period, entitlement to paid annual leave typically accrues after probation, though some leave types like sick leave may have different rules during this time.

Types of Leaves Covered Under UAE Labour Law

The UAE Labour Law provides for several types of leave, each with specific rules regarding duration and pay:

- Annual Leave: Paid time off for rest and recreation.

- Sick Leave: For recovery from illness or injury.

- Maternity Leave: For expectant and new mothers.

- Paternity Leave: For new fathers (introduced more formally in recent laws).

- Parental Leave: Additional leave for childcare post-maternity/paternity (often unpaid or subject to employer policy, though the law provides 5 days).

- Bereavement Leave: For the death of a close relative (spouse, parent, child, sibling, grandparent).

- Study Leave: For employees pursuing education, often subject to specific conditions.

- Sabbatical Leave: For UAE National employees for specific purposes (e.g., national service).

This guide primarily focuses on the salary calculations for the most common types: Annual, Sick, and Maternity leave.

Annual Leave Salary Deep Dive

H3: What Is Annual Leave Salary?

Annual leave salary is the payment an employee receives while taking their entitled annual vacation days. It ensures employees continue to receive their regular income during their approved time off.

When Is an Employee Entitled to Annual Leave?

Under Article 29 of the UAE Labour Law:

- After 1 Year of Service: Employees are entitled to 30 calendar days of paid annual leave per year.

- Between 6 Months and 1 Year of Service: Employees are entitled to 2 calendar days of paid leave for each month worked.

- During Probation: Technically, leave accrues from day one, but employers typically grant it after probation. If an employee leaves during probation, leave entitlement might be handled differently based on the contract or employer policy, though the law provides the basic accrual.

Calculation Formula for Annual Leave Salary

This is a critical point, especially following the implementation of Federal Decree-Law No. 33 of 2021.

Inclusion of Basic Salary vs Full Salary in Leave Calculation

- Leave Taken During Employment: When an employee takes their annual leave, Article 29(9) states they are entitled to their leave pay calculated based on the salary they receive during the leave period. The law generally interprets this as the full salary (basic salary + applicable allowances) as per the last paid wage before the leave starts.

- Payment Instead of Leave (Encashment): If an employee does not take their leave and is paid in lieu (usually upon termination, but sometimes during employment if agreed), Article 29(9) specifies this payment is calculated based only on the basic wage.

Key Takeaway:

- Leave Pay (Taken): Full Salary (Basic + Allowances)

- Leave Encashment (Paid instead of taken): Basic Salary Only

Always check your employment contract, but the law provides this default calculation method.

The Formula

The daily rate for leave calculation is typically derived from the relevant monthly salary:

- Daily Rate = (Monthly Full Salary for leave taken / 30 days)

- OR

- Daily Rate = (Monthly Basic Salary for leave encashment / 30 days)

Annual Leave Salary = Daily Rate * Number of Annual Leave Days Taken/Encashing

Example (Leave Taken):

- Monthly Full Salary (Basic + Allowances) = AED 10,000

- Leave Days Taken = 15

- Daily Rate = AED 10,000 / 30 = AED 333.33

- Leave Salary for 15 days = AED 333.33 * 15 = AED 5,000

Example (Leave Encashment on Termination):

- Monthly Basic Salary = AED 6,000

- Unused Leave Days = 10

- Daily Rate = AED 6,000 / 30 = AED 200

- Leave Encashment = AED 200 * 10 = AED 2,000

How to Calculate Leave Salary for Incomplete Years

For employees who haven’t completed a full year of service (but have passed 6 months), or for calculating leave entitlement up to a specific date (like termination), leave is calculated on a pro-rata basis.

- Accrual Rate: 2 days per month for service between 6 months and 1 year. For service over 1 year, it’s effectively 30 days / 12 months = 2.5 days per month.

- Calculation: (Number of months worked in the calculation period) * (Relevant accrual rate per month) = Total leave days accrued.

- Calculate the pay based on these accrued days using the formulas above (full salary if taken, basic if encashed).

Example (Termination after 1 year and 3 months):

- Leave for the first full year = 30 days

- Leave for the additional 3 months = 3 months * (30 days / 12 months) = 7.5 days

- Total accrued leave = 30 + 7.5 = 37.5 days

- If any leave was already taken, subtract it. The remaining balance is paid out (encashed) based on basic salary.

Leave Salary in Specific Scenarios

What Happens to Leave Salary During Probation Period?

- Employees accrue annual leave from day one, even during probation (typically max 6 months).

- However, employers usually only grant the leave after successful completion of probation.

- If employment is terminated during probation (by either party), the handling of accrued leave depends on the notice period rules and contract terms. As per the law, if the employee resigns during probation to join another UAE employer, the new employer may need to compensate the old one for recruitment costs unless specific notice is served. If the employee resigns to leave the UAE, specific notice is required otherwise they may face a ban. If the employer terminates, standard notice applies. Payment for accrued leave during probation upon termination isn’t explicitly mandated in the same way as post-probation leave, but it’s best practice and often included in settlements. Consult MOHRE or legal advisor for specifics.

Leave Salary During Resignation or Termination

Upon resignation or termination after the probation period:

- Employees are entitled to be paid for any unused accrued annual leave days.

- This payment is calculated based on the employee’s basic salary only, as per Article 29(9).

- The calculation uses the pro-rata method if the final year of service is incomplete.

Encashment of Unused Annual Leave: How It Works

- Mandatory Encashment: Primarily occurs upon termination of the employment contract for all accrued, unused leave days. Calculated on basic salary.

- Encashment During Employment: An employer and employee may agree to encash some leave days instead of the employee taking them, but this isn’t a right. If done, the calculation basis (basic or full) might depend on company policy or mutual agreement, though the law’s default for “payment in lieu” points towards basic salary. It’s generally encouraged for employees to take their leave for well-being.

- Carry Forward: Employees must generally take their leave within the year it’s due. Employers can allow carrying forward some leave (often up to half) to the next year by agreement or policy, but forcing forfeiture of legally entitled leave is generally not permitted. Article 29 states leave must be taken in the year it is due, or as agreed, otherwise payment in lieu (basic salary) is applicable.

Leave Salary on Final Settlement (End of Service)

Leave salary encashment forms a key part of the final settlement package, alongside:

- Final salary payment up to the last working day.

- End-of-service gratuity (if applicable).

- Notice period pay (if applicable).

- Repatriation ticket costs (if applicable under the contract/law).

- Any other contractual dues minus any deductions owed.

The leave pay component is calculated based on unused accrued days multiplied by the daily basic wage.

Handling Special Cases in Leave Salary Calculation

Leave Salary for Employees with Commission or Variable Pay

Calculating leave salary for employees whose income includes significant variable components like commission or bonuses requires careful consideration.

- Annual Leave Taken: The principle is that the employee should receive their “normal” pay during leave. For variable pay, MOHRE guidance and best practice often involve calculating an average earning over a recent period (e.g., the last 3 or 6 months) to determine the “full salary” for leave pay purposes. This average typically includes basic salary plus the averaged variable components. Check the employment contract for specific methods.

- Leave Encashment: As encashment is legally based on basic salary, commissions and bonuses are generally excluded from this calculation unless the contract explicitly states otherwise (which is rare).

How Public Holidays Affect Leave Salary

- If a public holiday (as officially declared in the UAE) falls within an employee’s approved annual leave period, it is considered part of the annual leave and is paid as such. It does not extend the annual leave duration unless the employer agrees otherwise. (Article 29(6))

- Public holidays are paid days off separate from the annual leave entitlement.

Other Key Leave Types and Salary Rules

Maternity Leave and Its Salary Rules in the UAE

Governed by Article 30 of the Labour Law:

- Duration: 60 calendar days.

- Pay:

- First 45 days: Full pay (basic + allowances).

- Next 15 days: Half pay (50% of full pay).

- Additional Unpaid Leave: An employee can take up to 45 additional unpaid days consecutively or non-consecutively if the absence is due to illness related to pregnancy or childbirth (medical certificate required).

- Post-Maternity Nursing Breaks: Entitled to paid nursing breaks after returning to work.

Sick Leave Salary: Calculation and Entitlement

Governed by Article 31 of the Labour Law:

- Eligibility: After the probation period, an employee is entitled to sick leave. During probation, sick leave may be unpaid unless the employer decides otherwise.

- Maximum Duration: Up to 90 calendar days per year (continuous or intermittent).

- Notification: Employee must notify the employer within 3 working days and provide a medical certificate.

- Pay Calculation:

- First 15 days: Full pay (basic + allowances).

- Next 30 days: Half pay (50% of full pay).

- Remaining 45 days: Unpaid.

Practical Tools and Compliance

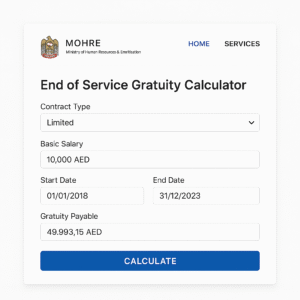

Official MOHRE Leave Salary Calculator: How to Use It

MOHRE often provides online tools and calculators on its website or app to help estimate entitlements like gratuity. While a dedicated, universally applicable “leave salary calculator” might be complex due to variations (full vs. basic pay scenarios, variable pay), MOHRE’s resources can be helpful.

- How to Find: Check the official MOHRE website (www.mohre.gov.ae) or the MOHRE mobile app for available calculators or guidance sections.

- Usage: You typically need to input details like contract start date, end date (if applicable), basic salary, and potentially allowances.

- Limitations: These calculators provide estimates based on standard interpretations of the law. Always refer to your specific contract and the nuances discussed (like basic vs. full pay for different scenarios) for definitive calculations.

Employer Violations: What to Do if Leave Salary Isn’t Paid

If an employer fails to pay the correct leave salary or denies entitled leave:

- Internal Discussion: First, discuss the issue politely with your HR department or manager, referencing your contract and the UAE Labour Law.

- Formal Complaint: If unresolved, you can file a formal labour complaint with MOHRE. This can often be done online, via the app, or by calling their helpline (80060).

- MOHRE Intervention: MOHRE will investigate the complaint and attempt mediation. If mediation fails, the case may be referred to the labour courts.

read about :UAE Leave Salary Calculator Online: The Ultimate 2025 Guide to Your Entitlement

Frequently Asked Questions (FAQs) on Leave Salary

Can my employer dictate when I take my annual leave?

Yes, the employer has the right to specify the dates of annual leave based on work requirements and schedules, although they should try to accommodate employee preferences where possible. They must notify the employee at least one month in advance. (Article 29(4)).

Is airfare allowance included in leave salary calculation?

Airfare allowance is typically a separate entitlement specified in the employment contract. It’s generally not included in the monthly salary used for calculating leave pay unless the contract explicitly integrates it into the regular monthly compensation structure used for calculating leave (which is uncommon). The payment for leave itself is based on salary (basic or full, as explained).

Can unused annual leave be forfeited?

Generally, no. Employees must be allowed to take their leave or be paid in lieu upon termination (based on basic salary). While carry-over limits exist, outright forfeiture of legally accrued leave without compensation is typically against the law’s principles.

H4: How is leave calculated if I work less than 6 months?

The law grants 2 days of leave per month after completing 6 months of service. Before completing 6 months (i.e., during initial probation), entitlement might not be formally granted for taking leave, though it technically accrues. If termination occurs very early, any payment for minimal accrued leave would be based on company policy or negotiation, as the law focuses entitlement after 6 months.

Recent Updates or Changes in UAE Leave Salary Rules

The most significant recent change is the Federal Decree-Law No. 33 of 2021, which came into effect in February 2022. This law replaced the previous Federal Law No. 8 of 1980. Key changes impacting leave include:

- Clearer definitions for different leave types (Paternity, Bereavement, Study Leave).

- Standardized annual leave at 30 calendar days after one year.

- Specific pay structures for Maternity and Sick Leave.

- Introduction of part-time and flexible work models with pro-rata entitlements.

- Clarification on leave pay calculation (full salary when taken, basic salary for encashment).

Staying updated with MOHRE announcements is crucial as interpretations and minor regulations can evolve.

Leave Salary for Part-Time Employees

Article 17 of the Executive Regulations of the Labour Law clarifies that part-time employees are entitled to annual leave on a pro-rata basis. The calculation depends on the actual hours worked compared to a full-time schedule.

- Formula Concept: (Part-time hours worked / Full-time hours) * Standard Annual Leave Entitlement (e.g., 30 days).

- The specific method should be outlined in the part-time employment contract.

- Leave salary calculation would follow the same principles (full pay if taken, basic pay if encashed) based on their pro-rated salary structure.

Key Legal References from UAE Labour Law (Federal Decree-Law No. 33 of 2021)

Understanding the source of these rules is important:

- Article 29: Governs Annual Leave entitlement, calculation, carry-forward, payment during leave, and payment in lieu (encashment). Crucially distinguishes pay basis for leave taken vs. encashment.

- Article 30: Details Maternity Leave duration and pay structure.

- Article 31: Outlines Sick Leave entitlement, duration, notification, and pay structure.

- Article 32: Covers other leaves like Bereavement, Parental, Sabbatical, Study leave.

- Article 1 (Definitions): Defines terms like “Basic Wage” and “Wage” (which includes allowances).

- Executive Regulations: Provide further detail on implementing the law, including part-time work rules.

Role of HR and Payroll Departments in Leave Management

HR and Payroll departments play a vital role:

- Policy Development: Creating clear, compliant leave policies.

- Record Keeping: Accurately tracking leave accrual, usage, and balances for all employees.

- Calculation: Ensuring correct calculation of leave pay and encashment according to the law and contract.

- Communication: Informing employees about their leave entitlements and balances.

- Compliance: Staying updated with MOHRE regulations and ensuring company practices align.

- System Management: Utilizing HRMS/Payroll systems to manage leave efficiently and accurately.

Best Practices for Employers to Ensure Compliance

To avoid disputes and ensure fairness:

- Clear Contracts: Ensure employment contracts clearly state basic salary, allowances, and reference adherence to UAE Labour Law for leave.

- Written Policies: Maintain an updated employee handbook outlining all leave policies, including application procedures and calculation methods.

- Accurate Systems: Use reliable HR/Payroll software to track accruals and calculate pay correctly.

- Transparency: Provide employees regular access to their leave balance information.

- Train Staff: Ensure HR/Payroll staff are well-versed in the latest UAE Labour Law provisions.

- Adhere to Law: Strictly follow the calculation methods specified in the law (full pay for leave taken, basic for encashment).

- Timely Payments: Ensure leave salaries and final settlements (including leave encashment) are paid promptly.

Conclusion:

Understanding leave salary calculation in the UAE is essential for maintaining a compliant and fair workplace. The UAE Labour Law (Federal Decree-Law No. 33 of 2021), overseen by MOHRE, provides a clear framework, particularly regarding annual leave, sick leave, and maternity leave. Key takeaways include the distinction between calculating pay for leave taken (full salary) versus leave encashment (basic salary), the pro-rata rules for incomplete service, and the specific pay scales for sick and maternity leave. By adhering to these regulations, both employees and employers can navigate leave entitlements confidently.

[Disclaimer: This blog post provides general information based on the UAE Labour Law as of 2025. Specific situations may vary based on individual contracts and circumstances. It is always advisable to consult with MOHRE or a legal professional for advice tailored to your specific case.]

Pingback: Master Leave Salary Calculation in UAE in Excel (2025): Formulas & Free Template Ideas - saasexpertpicks