Does bill.com integrate with sun accounting software Discover how integrating Bill.com with Sun Accounting Software can automate your financial processes, reduce errors, and provide real-time data access. Our comprehensive guide covers everything you need to know!

Overview of Bill.com as a Cloud-Based Financial Platform.

Bill.com is a leading, cloud-based financial platform designed to simplify and automate accounts payable and receivable processes. It offers a comprehensive suite of tools that enable businesses to manage invoices, payments, and approvals efficiently. By leveraging cloud technology, Bill.com provides real-time access to financial data, facilitates multi-user collaboration, and integrates seamlessly with various accounting systems. This platform is invaluable for businesses seeking to streamline their financial operations and reduce manual workload.

Overview of Sun Accounting Software as a Comprehensive Financial Management Solution.

Sun Accounting Software is a robust and comprehensive financial management solution that caters to the complex needs of businesses. It offers multi-currency support, flexible chart of accounts, advanced budgeting tools, and powerful financial reporting capabilities. Sun Accounting Software is designed to provide businesses with a holistic view of their financial health, enabling informed decision-making and efficient financial management. Its integration capabilities with third-party applications further enhance its versatility and functionality.

The Importance of Integrating Financial Systems

Benefits of System Integration in Financial Management.

Integrating financial systems, such as Bill.com and Sun Accounting Software, offers numerous benefits that can significantly impact a business’s efficiency and accuracy. These benefits include:

- Automation of Repetitive Tasks: Integration automates manual data entry and processing, saving time and reducing errors.

- Real-Time Data Synchronization: Integrated systems provide real-time access to synchronized financial data, ensuring accurate and up-to-date information.

- Improved Accuracy: Eliminating manual data entry minimizes the risk of errors, leading to more accurate financial reporting.

- Enhanced Efficiency: Streamlined workflows and automated processes improve overall efficiency and productivity.

- Better Decision-Making: Access to real-time, accurate data enables informed and timely financial decisions.

Challenges Faced Without Integrated Systems.

Without integrated systems, businesses often face several challenges that can hinder their financial management:

- Manual Data Entry Errors: Manual data entry is prone to errors, leading to inaccurate financial records.

- Time-Consuming Processes: Manual processes are time-consuming and inefficient, reducing productivity.

- Data Silos: Disparate systems create data silos, making it difficult to access and analyze financial information.

- Lack of Real-Time Visibility: Without real-time data synchronization, businesses lack visibility into their current financial status.

- Increased Operational Costs: Inefficient processes and manual errors increase operational costs.

Compatibility Between Bill.com and Sun Accounting Software

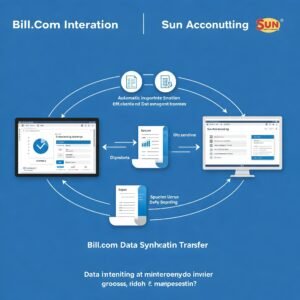

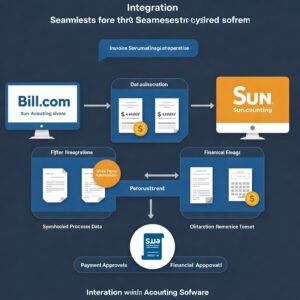

Discuss the Seamless Integration Capabilities Between the Two Platforms.

Bill.com and Sun Accounting Software offer seamless integration capabilities, allowing businesses to connect their financial systems and streamline their workflows. This integration enables automatic data synchronization, eliminating the need for manual data entry and reducing the risk of errors. 1 By connecting these two platforms, businesses can achieve greater efficiency and accuracy in their financial management.

Highlight Any Prerequisites for Integration.

To ensure a smooth integration process, businesses should be aware of certain prerequisites:

- Compatible Software Versions: Ensure that both Bill.com and Sun Accounting Software are running on compatible versions.

- Appropriate User Permissions: Users attempting to integrate the systems should have the necessary administrative privileges.

- Stable Internet Connection: A stable internet connection is required for seamless data synchronization.

- Accurate Data Mapping: Proper data mapping is crucial to ensure accurate data transfer between the two platforms.

Key Features of Bill.com

Automated Accounts Payable and Receivable.

Bill.com automates accounts payable and receivable processes, streamlining invoice management, payment processing, and approval workflows. This automation reduces manual workload and minimizes errors.

Cloud-Based Access and Multi-User Collaboration.

Bill.com’s cloud-based platform enables real-time access to financial data and facilitates multi-user collaboration. This feature enhances teamwork and ensures that everyone has access to the latest information.

Integration with Various Accounting Systems.

Bill.com integrates seamlessly with various accounting systems, including Sun Accounting Software, providing a unified financial management experience.

Key Features of Sun Accounting Software

Multi-Currency Support and Financial Reporting.

Sun Accounting Software offers multi-currency support and robust financial reporting capabilities, enabling businesses to manage international transactions and generate insightful financial reports.

Flexible Chart of Accounts and Budgeting Tools.

The software provides a flexible chart of accounts and advanced budgeting tools, allowing businesses to customize their financial management to meet their specific needs.

Integration Capabilities with Third-Party Applications.

Sun Accounting Software’s integration capabilities with third-party applications, including Bill.com, enhance its versatility and functionality.

Benefits of Integrating Bill.com with Sun Accounting Software

Time-Saving Through Automation of Repetitive Tasks.

Integrating Bill.com with Sun Accounting Software automates repetitive tasks, such as data entry and payment processing, saving valuable time and resources.

Reduction of Manual Entry Errors.

By eliminating manual data entry, integration significantly reduces the risk of errors, leading to more accurate financial records.

Real-Time Access to Synchronized Financial Data.

Integration provides real-time access to synchronized financial data, ensuring that businesses have up-to-date information for informed decision-making.

Step-by-Step Guide to Integration

Detailed Instructions on Connecting Bill.com with Sun Accounting Software.

- Prepare Both Systems: Ensure that both Bill.com and Sun Accounting Software are updated and running on compatible versions.

- Access Integration Settings: Navigate to the integration settings within either Bill.com or Sun Accounting Software.

- Establish Connection: Follow the prompts to establish a connection between the two platforms, providing the necessary credentials.

- Map Data Fields: Carefully map the data fields between the two systems to ensure accurate data transfer.

- Test Integration: Conduct thorough testing to verify that data is syncing correctly between Bill.com and Sun Accounting Software.

- Monitor Synchronization: Regularly monitor the synchronization process to identify and address any potential issues.

Tips for a Smooth Integration Process.

- Plan the integration carefully, outlining the specific goals and requirements.

- Ensure that all users involved in the integration process are properly trained.

- Conduct thorough testing before going live with the integrated system.

- Maintain regular communication between the teams responsible for Bill.com and Sun Accounting Software.

Common Challenges and How to Overcome Them

Potential Data Sync Errors and Solutions.

Potential data sync errors can arise during integration. To overcome these challenges:

- Verify Data Mapping: Double-check the data mapping to ensure accuracy.

- Monitor Sync Logs: Regularly review sync logs to identify and resolve errors.

- Test Data Integrity: Conduct regular data integrity checks to ensure accuracy.

Ensuring Data Security During Integration.

Data security is paramount during integration. To ensure data protection:

- Use Secure Connections: Utilize secure connections and encryption protocols.

- Implement Access Controls: Implement strict access controls to limit data access.

- Regular Security Audits: Conduct regular security audits to identify and address vulnerabilities.

Addressing Compatibility Issues.

Compatibility issues can arise due to different software versions or configurations. To address these issues:

- Update Software: Ensure that both Bill.com and Sun Accounting Software are updated to the latest versions.

- Consult Documentation: Refer to the official documentation for compatibility guidelines.

- Contact Support: Contact the support teams for both platforms for assistance.

Case Studies: Successful Integrations

Real-World Examples of Businesses Benefiting from the Integration.

Numerous businesses have successfully integrated Bill.com with Sun Accounting Software, resulting in significant improvements in their financial management. These case studies highlight the tangible benefits of integration, including reduced manual workload, improved accuracy, and enhanced efficiency.

Lessons Learned and Best Practices.

From these case studies, several lessons learned and best practices emerge:

- Thorough planning and testing are crucial for a successful integration.

- Clear communication between teams is essential.

- Regular monitoring and maintenance are necessary to ensure ongoing efficiency.

Security Considerations

Ensuring Data Protection During and After Integration.

Data protection is crucial during and after integration. Businesses should implement robust security measures, including encryption, access controls, and regular backups.

Compliance with Financial Regulations.

Businesses must ensure compliance with relevant financial regulations, such as GDPR and PCI DSS. Implementing secure integration practices can help maintain compliance.

Customization and Scalability

Tailoring the Integration to Fit Specific Business Needs.

The integration can be tailored to fit specific business needs by customizing data mapping, workflows, and reporting.

Scalability of the Integrated System for Growing Businesses.

The integrated system should be scalable to accommodate the needs of growing businesses. Cloud-based solutions like Bill.com offer excellent scalability.

Training and Support for Staff

Importance of Training Employees on the Integrated System.

Proper training is essential for employees to effectively use the integrated system. Training should cover all aspects of the integration, including data entry, reporting, and troubleshooting.

Available Support Resources from Bill.com and Sun Accounting Software.

Both Bill.com and Sun Accounting Software provide support resources, including online documentation, tutorials, and customer support.

Cost-Benefit Analysis

Evaluating the Financial Investment Versus the Expected Benefits.

Businesses should conduct a thorough cost-benefit analysis to evaluate the financial investment versus the expected benefits of integration.

Long-Term Savings and ROI from Integration.

Integration can lead to long-term savings and a positive ROI through improved efficiency, reduced errors, and enhanced decision-making.

Impact on Financial Reporting

Enhancements in Reporting Accuracy and Timeliness.

Integration enhances reporting accuracy and timeliness by providing real-time access to synchronized data.

Customization of Reports Post-Integration.

Businesses can customize reports post-integration to meet their specific reporting needs.

User Experience and Interface

Navigating the Integrated System.

The integrated system should provide a user-friendly experience with intuitive navigation.

User Feedback and Satisfaction Levels.

Gathering user feedback and monitoring satisfaction levels can help identify areas for improvement.

Future Trends in Financial Software Integration

Emerging Technologies and Their Potential Impact.

Emerging technologies, such as AI and blockchain, will continue to impact financial software integration.

Predictions for the Evolution of Financial System Integrations.

Financial system integrations will become more intelligent and automated, enhancing efficiency and accuracy.

Comparing Bill.com and Sun Accounting Software Integration with Other Solutions

How This Integration Stands Out From Others in the Market.

This integration stands out due to its seamless data synchronization, robust security features, and customizable workflows.

Unique Features and Advantages.

Unique features and advantages include real-time data access, automated processes, and enhanced reporting capabilities.

Legal and Compliance Aspects

Understanding the Legal Implications of Financial Data Integration.

Businesses must understand the legal implications of financial data integration, including data privacy and security regulations.

Ensuring Compliance with Industry Standards.

Compliance with industry standards, such as GAAP and IFRS, is essential for accurate financial reporting.

Maintenance and Updates Post-Integration

Regular System Checks and Updates.

Regular system checks and updates are necessary to ensure the ongoing efficiency and security of the integrated system.

Managing Changes and Upgrades in Either Platform.

Businesses should have a plan for managing changes and upgrades in either Bill.com or Sun Accounting Software.

Conclusion and Final Thoughts

Integrating Bill.com with Sun Accounting Software offers numerous benefits, including improved efficiency, reduced errors, and enhanced financial management. Businesses should consider this integration to streamline their financial operations and achieve long-term success.

Read More :

- Is Computer Software Prepackaged Software a Good Career Path? Exploring Opportunities, Skills, and Growth in the US -Hurray! Best of 2025

- What is the suggested first step for entering software development-Hurray! Best Guide of 2025

- B2B Lead Generation : Mastering The Ultimate Playbook in 2025